China’s better economic growth hides reasons to worry

W hen China’s leaders set an economic-growth target of “around” 5% for this year, the goal was universally described as ambitious. Now the country looks increasingly likely to meet it. Several foreign banks, including Citigroup, Goldman Sachs and Morgan Stanley, have recently raised their forecasts. Figures released on April 16th showed the economy grew by 5. 3% in the first quarter, compared with a year earlier—quicker than expected and faster than the target requires.

W hen China’s leaders set an economic-growth target of “around” 5% for this year, the goal was universally described as ambitious. Now the country looks increasingly likely to meet it. Several foreign banks, including Citigroup, Goldman Sachs and Morgan Stanley, have recently raised their forecasts. Figures released on April 16th showed the economy grew by 5. 3% in the first quarter, compared with a year earlier—quicker than expected and faster than the target requires.

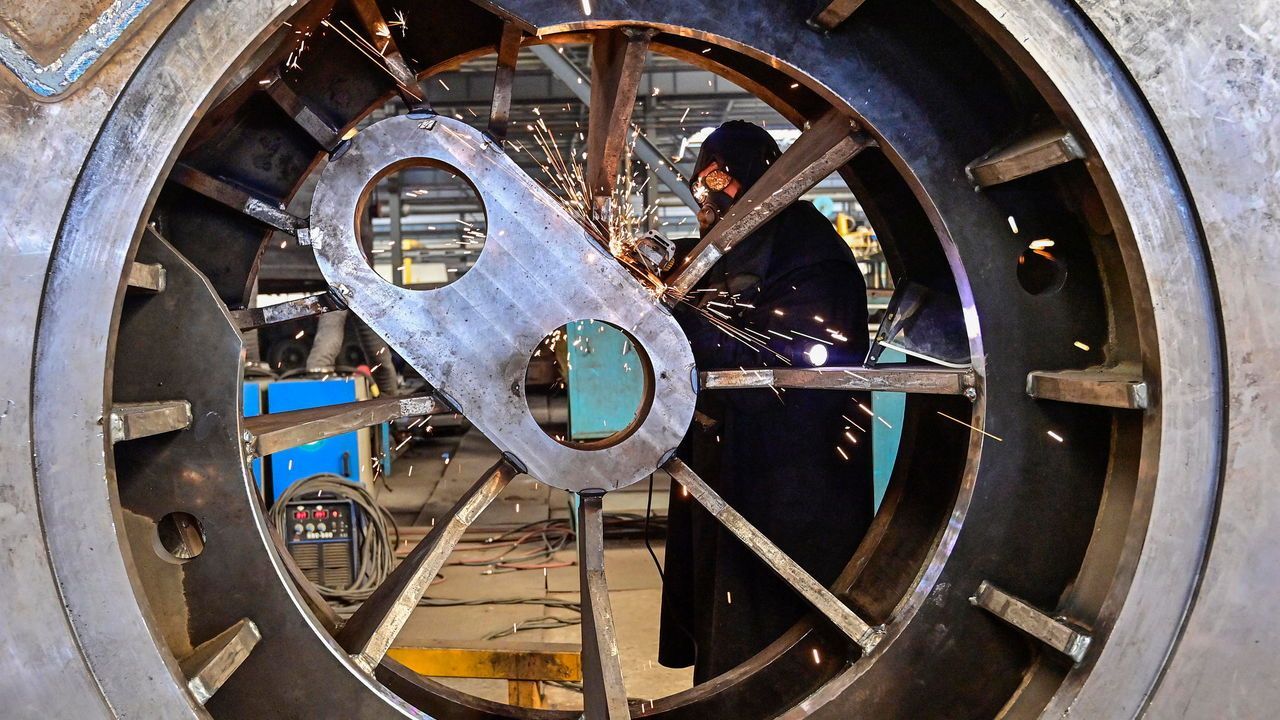

How is this happening? Countries at China’s stage of development often shift towards services. But China’s leaders have a soft spot for “hard” output. Xi Jinping, the country’s ruler, sees manufacturing as a source of both prosperity and security. He covets what officials call a “complete” industrial chain that would free China from reliance on foreign powers for vital technological inputs. To that end, his latest five-year plan aims to stop the steady decline in manufacturing’s share of GDP.

The first three months of this year were consistent with that long-term goal. Manufacturing output grew by 6. 7% compared with a year ago, faster than the overall economy. High-tech manufacturing fared even better, expanding by 7. 5%. China’s leaders have talked a lot about the need to cultivate “new quality productive forces”, buzzwords that appeared in the monthly press release from the National Bureau of Statistics for the first time, even if the statisticians did not elaborate on how these forces could be measured.

China is determined to wean itself off foreign suppliers. Yet the early months of this year highlighted a different kind of dependency: reliance on foreign buyers. China’s volume of exports grew by 14% in the first quarter compared with a year earlier, according to Zhiwei Zhang of Pinpoint Asset Management. Falling prices and a competitive currency have helped. According to America’s Bureau of Labour Statistics, the price of goods from China fell by 2. 9% year-on-year in the first quarter. That is the third-steepest drop on record.

Some analysts worry that China cannot rely on strong exports for long without provoking a protectionist backlash from its trading partners. Olaf Scholz, chancellor of Germany, raised fears about Chinese overcapacity when he met Mr Xi in Beijing on April 16th. Europe’s largest economy used to benefit from China’s economic progress. It sold sophisticated industrial goods to China, even as China’s manufacturers conquered lower-end markets around the world. Now the two countries have become rivals in many industries Germany holds dear, including chemicals, machinery and, of course, cars.

China’s reliance on markets abroad reflects some enduring weaknesses at home. Retail sales were surprisingly poor in March. Consumer confidence remains low. And the property market’s misery continues. The price of new flats in 70 of China’s biggest cities fell by 2. 2% on average in March compared with a year earlier, the steepest drop since 2015, according to Reuters, a news agency. Sales of newly built residential housing fell by over a fifth.

The slump in China’s property market has contributed to falling prices in many related parts of the economy, such as building materials and housing appliances. That has deepened deflation’s grip on the economy. Factory-gate prices have now fallen for 18 months in a row. Consumer price inflation, after a brief uptick during the lunar new year holiday in February, remained near zero in March. Declining prices are, of course, a double-edged sword, as Ting Lu of Nomura, a bank, has pointed out. They have increased China’s competitiveness abroad, which is one reason why the country’s exports have been surprisingly strong. But if deflation persists it could erode revenues, making debts harder to bear. It might also force companies to cut wages, which will do nothing to restore household morale or spending.

For all the paranoia of China’s leaders, they seem worryingly complacent about the danger of deflation. Perhaps they view it as a blip, which should not distract them from long-term aims to fortify China against shifts in the global balance of power—what Mr Xi calls “changes unseen in a century”. Falling prices can, though, turn a passing downturn into a protracted slump. This week’s figures showed that China’s GDP deflator, a broad measure of prices, has fallen for four quarters in a row. That has not happened since 1999. Or to put it in terms Mr Xi might appreciate, it is a change unseen this century. ■

Hint: it is not a fondness for cryptocurrencies

Statisticians take the country’s figures with a pinch of salt

The world’s third-largest producer is now an importer of petrol

Advertising on our project is a great way to promote a brand and attract new customers for your company!

Advertising on our project is a great way to promote a brand and attract new customers for your company!  AUD: 0.6568 $

AUD: 0.6568 $  CAD: 0.7325 $

CAD: 0.7325 $  CHF: 1.0966 $

CHF: 1.0966 $  CNY: 0.1381 $

CNY: 0.1381 $  EUR: 1.0720 $

EUR: 1.0720 $  GBP: 1.2539 $

GBP: 1.2539 $  JPY: 0.0064 $

JPY: 0.0064 $  RUB: 0.0109 $

RUB: 0.0109 $