IQ Credit — сервис подбора кредитов, и как конкурентам мешает успех IQ Credit.

Компания IQ Credit уже не первый год предлагает помощь в получении кредита и за время своей коммерческой деятельности помогла тысячам россиян получить займы на разные суммы и разные потребности.

Активная деятельность и повышение популярности не понравилось конкурентам, которые осенью 2021 года начали информационную атаку на IQ Credit. Она достаточно нелепо организована, поэтому заказной характер низкокачественных отзывов, размещенных на разных сайтах-отзовиках, заметен сразу.

“Взяли с меня деньги, а потом исчезли в туман. Теперь вообще трубки не берут”, — пишет некто tapinatatiana.

Тут сразу две неправды:

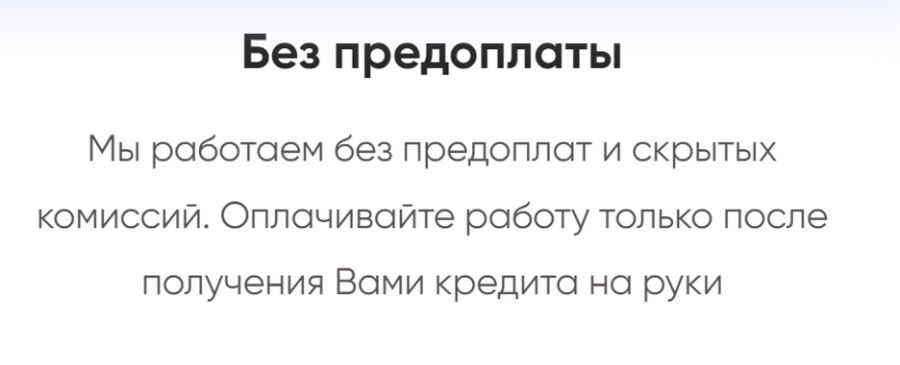

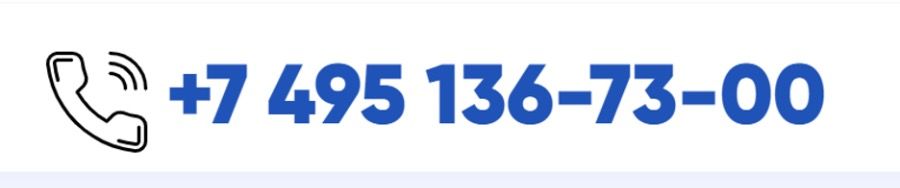

- По-первых, никаких предоплат IQCredit не взимает. Любой может в этом убедиться, позвонив по телефону, указанному на официальном сайте www.iq-credit.ru или www.credit-iq.ru .

- Во-вторых, ни в какой туман никто не исчезал. Компания работает официально, ее телефон доступен. И tapinatatiana, и другие, могут убедиться, набрав +7 495 136-73-00. Обратите внимание, это — не мобильный, а городской московский номер.

Похожий отзыв оставила некто Олеся, уточняя, что не могла взять кредит в нескольких банках, но от сотрудничества отказалась, так как “прочитала до этого отзывы о нескольких недобросовестных брокерах и знала, к чему готовиться”.

Да, бывает такое, когда банк не дает кредит. Но когда в предоставлении займа отказывают сразу несколько банков, наверняка, это не спроста. Вполне вероятно, этому есть особые причины. Возможно, просрочка по кредитной карте, а может быть, задолженность по текущему кредиту.

Печально, что вместо решения конкретных проблем человек ищет в интернете отзывы о недобросовестных брокерах и на основе этого делает выводы.

Если читать отзывы о черных риелторах, квартиру покупать перехочется; а если видео об автоподставах, садиться за руль будет страшно!

Негативные отзывы не подтверждаются указанием подробной информации, таким образом, невозможно идентифицировать тех, кто их оставил. Пример: человек жалуется на то, что сотрудничество с сервисом — “это просто ужас”, предъявляет, что “кинули, отдала аванс, и теперь не дозвониться никак”.

Но ведь телефон, как и ранее, размещен на официальном сайте, операторы готовы предоставить консультацию. То есть, это явное вранье. Неправдивость отзыва подтверждается тем, что в ответ на предложение предоставить фото договора с печатью сервиса и подписью руководителя ответа не поступает. Оно и не странно, ведь предоставить ровным счетом ничего.

Отзывы об IQ Credit действительно стоит искать и читать, ведь подавляющее большинство — положительные. Но, как известно, ложка дегтя портит бочку меда. По этой причине такое небольшое расследование призвано опровергнуть негативные отзывы, которые, к слову, может оставить каждый, без какого-либо подтверждения своей личности.

Кому это выгодно?

Почему же в последнее время осуществляется такая информационная атака в адрес компании IQ Credit?

Ответ прост — завидуют конкуренты. Их усилия сложно назвать черным пиаром, ведь это просто отзывы, не самые профессиональные. При детальном рассмотрении четко заметен их заказной характер, хотя бы потому, что после уточняющего вопроса представителя компании недовольные отказываются предоставить доказательства правдивости информации. А ведь если так подумать, то им это должно быть выгодно!

Кто же занимается подобным? Показать пальцем на конкретных лиц не представляется возможным. Но, в целом, ситуация ясна.

Дело в том, что рынок банковского кредитования — это триллионная индустрия. Но есть категория граждан, которым банки стабильно отказывают в кредитах.

Можно подумать, что это студенты и другие молодые люди, у которых нет кредитной истории и ликвидного залога, но нет! Чаще всего у тех, кто получил отказ, кредитная история имеется, но она достаточно отрицательная. Более того, у человека могут иметься действующие кредиты с длительными просрочками.

Конечно, брать очередной кредит на то, чтобы покрыть долги по предыдущему или предыдущим, — решение не самое грамотное, но речь об этом идет не всегда. Бывает так, что человек с горем пополам рассчитался по долгу, допустил немалое количество просрочек, из-за чего заработал “черную метку”. Потом ему снова понадобились услуги — но теперь банк отказывает.

Вот тут в игру вступают разного рода сервисы, которые предоставляют помощь в получении кредита, среди них — IQ Credit.

Можно подумать, что это — банальное посредничество, но нет. В то время как многие компании фактически ничего полезного не делают, в IQ Credit нацелены на результат. Компания предлагает уникальную услугу, которая заключается в подборе выгодного кредита с низкой ставкой без справки о доходах с последующим одобрением всего за три часа.

Согласитесь, звучит привлекательно и даже неправдоподобно, но обмана здесь никакого нет и быть не может!

На сайте прямым текстом написано — предоплата не требуется. Никаких скрытых комиссий, оплату компания взимает лишь в том случае, когда кредит фактически получен на руки.

Телефон? Да вот же он, на главном сайте — не молчит, отвечает. Любой — и действующий клиент, и будущие заказчики услуги — могут обратиться за консультацией.

За счет чего зарабатывает IQ Credit?

Может возникнуть вполне закономерный вопрос, а за счет чего зарабатывает компания IQ Credit, если подать заявку на кредит каждый может самостоятельно, более того, подать 5 заявок в 5 разных банков? Сервисов, которые предлагают автоматический подбор кредита — великое множество.

Это верно, но принципиальное отличие IQ Credit — в том, что компания работает по партнерским соглашениям с коммерческими банками.

Вы наверняка не раз видели рекламу банков, она везде — и в интернете, а на билбордах, и на телевидении. Финансовые организации тратят огромные деньги на то, чтобы привлекать вкладчиков, заемщиков, физических и юридических лиц.

Но есть и другой способ: банк может заключить партнерское соглашение с агентством, которое обязуется поставлять ему большое количество клиентов. Так проще — и все довольны:

- Банк получает реальных клиентов;

- Те, кто ранее столкнулся с проблемами в одобрении займов, получают одобрение;

- Компания, как результат, получает свою комиссию, которая формируется как за счет сотрудничества с банками, так и за счет комиссии, которую оплачивают клиенты.

В итоге все довольны. Не получилось — ничего оплачивать не надо. Получилось — клиент получает кредит в банке — именно в банке, а не у какого-то частного кредитора, все официально.

Понятное дело, что такое положение дел устраивает не всех. Далеко не каждая компания имеет возможность заключить партнерские соглашения с коммерческими банками. Многие ограничиваются лишь чистым посредничеством, которое и посредничеством назвать нельзя, ведь зачастую это — просто веб-сайт, где размещена форма для подачи заявки в большое количество банков. Взимается предоплата, и если что-то пошло не так, она не возвращается.

Таким образом, отрицательные отзывы о компании IQ Credit оставляют пользователи, которых нанимают конкуренты, или такие сервисы, которые и конкурентами назвать нельзя.

IQ Credit — это подбор лучшего кредита. Просто позвоните по телефону — реальному телефону, который реально работает, а не молчит, как утверждают некоторые!

EUR: 92.0938 руб 0.62

EUR: 92.0938 руб 0.62  USD: 78.2267 руб 0.78

USD: 78.2267 руб 0.78  GBP:105.6060 руб 1.00

GBP:105.6060 руб 1.00  CNY: 11.1592 руб 0.11

CNY: 11.1592 руб 0.11  CHF: 99.1969 руб 0.96

CHF: 99.1969 руб 0.96  UAH: 18.5293 руб 0.12

UAH: 18.5293 руб 0.12  BYN: 26.9496 руб 0.17

BYN: 26.9496 руб 0.17  CAD: 57.1582 руб 0.52

CAD: 57.1582 руб 0.52  Реклама у нас - отличный способ продвижения бренда и привлечения новых клиентов для вашей компании!

Реклама у нас - отличный способ продвижения бренда и привлечения новых клиентов для вашей компании!  AUD: 0.6675 $

AUD: 0.6675 $  JPY: 0.0063 $

JPY: 0.0063 $  RUB: 0.0126 $

RUB: 0.0126 $